J&C Blog

Find all the latest marketing trends on the J&C Blog.

Find all the latest marketing trends on the J&C Blog.

Savvy financial marketing coupled with ongoing development of customer products is the solution to the rapidly declining number of millennials who have a traditional bank as their primary financial institution.

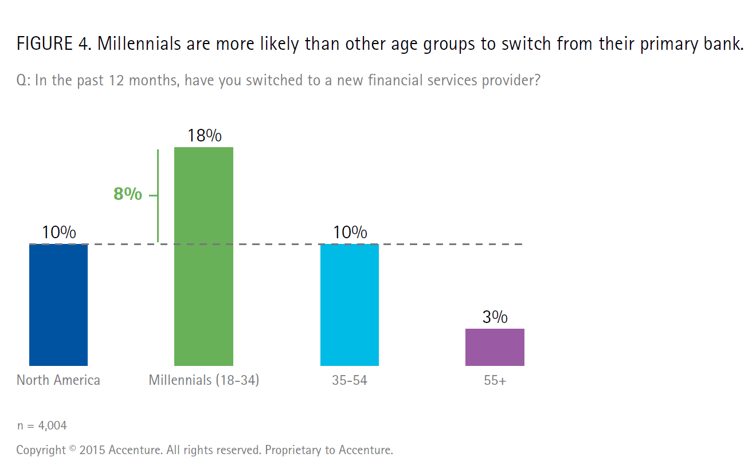

Millennials switch from their primary bank at a pace nearly double the average of other age groups, reported Accenture.

Moreover, 33% of millennials believe that they will eventually not need a bank at all, according to the Millennial Disruption Index, a three-year survey of more than 10,000 millennials.

Millennials are the generation most attuned to the banking industry’s shortcomings, but they’re really just the canary in a coal mine or, more appropriately, they are 80 million canaries. Generation Z is right around the corner and they are going to demand faster, better, more personalized digital experiences at an even greater rate than millennials.

Solving the millennials retention problem will create better experiences overall for older customers and help enable banks to think ahead to Generation Z’s needs as well.

While banks were once considered an integral part of the community, the four leading banks in the country are four of millennials’ least liked brands. What’s more, millennials who don’t actively dislike traditional banks often report that their banking experience is just ordinary and don’t see the difference between their bank and other banks.

Fintech companies are gaining a larger share of the millennial market and achieving more positive brand recognition because they are creating more agile, personalized experiences. They are also demonstrating a deeper understanding of millennial financial situations and how the recession impacted this group’s financial habits and attitudes.

Fintech companies don’t often have access to greater resources than traditional financial institutions. So how are they able to win millennials’ trust and retain these customers when banks are not?

Millennials judge banks on two primary qualities:

Fintech companies use financial marketing and branding to create the perception that they are acting as financial advisors to their customers. These brands also use multi-touchpoint, personalized marketing workflows to present information and services at the right time — when the customer is already in the buying mindset. This leads to greater cross-sell opportunities, improved customer retention and satisfaction, and a positive brand reputation.

While marketers may not be able to create new products faster, they are able to frame the discussion around the products and services available and create the experiences that enable banks to act as members’ financial caretakers.

The latest in marketing technology enables financial marketers to create multi-touch, multi-dimensional experiences to better fit the user’s personal goals and banking journey.

“[Millennials] have a firm belief that the insights of modern technology can be competitive with someone who is personally advising you, and at a fraction of the cost,” Luis Viceira, George E. Bates Professor and Senior Associate Dean for International Development at Harvard Business School, told Forbes.

Thanks to millennials’ dependence on digital channels, banks are able to act as financial advisors without having to invest in the costly overhead personnel would require. Instead, banks can develop the digital tools and experiences that personalize advice to the individual.

More often than not, many great tools and services are already developed, but the initial concept or presentation doesn’t fit within the unique digital-savvy behavior that helps define this generation. The presentation and back-end workflows for these tools and services are like parts of an engine not properly hooked up because financial decisions are not based on linear thinking and progression, which means workflows shouldn’t be either.

If humans made linear decisions, we would be more like Vulcans.

Hot tip: Each sliver of financial advice can be repurposed into more than 25 different pieces of content to reach different types of customers.

Marketing is the secret to staving off the millennial exodus banks are seeing today. With the right financial marketing strategies in place, banks can better convince millennials that they are a trusted resource and able to financially guide their customers with personalized advice. Building that relationship and perception will improve millennial retention levels and create cross-selling opportunities in the future.

Topics: Financial Services

303 E Wacker Drive, Suite 2030

Chicago, IL 60601

Phone: 312-894-3000

Fax: 312-894-3005