J&C Blog

Find all the latest marketing trends on the J&C Blog.

Find all the latest marketing trends on the J&C Blog.

These days marketing is multichannel, with multiple efforts, multiple touchpoints, and multiple ways of reaching consumers. And although reaching out may be a multi-channel, multi-effort endeavor, the way consumers respond is now more singular than ever before...

People prefer to respond online.

More and more customers are responding to direct mail packages via a customized landing page, microsite, web form, etc. rather than a traditional paper application or (even more rare) by going into a branch.

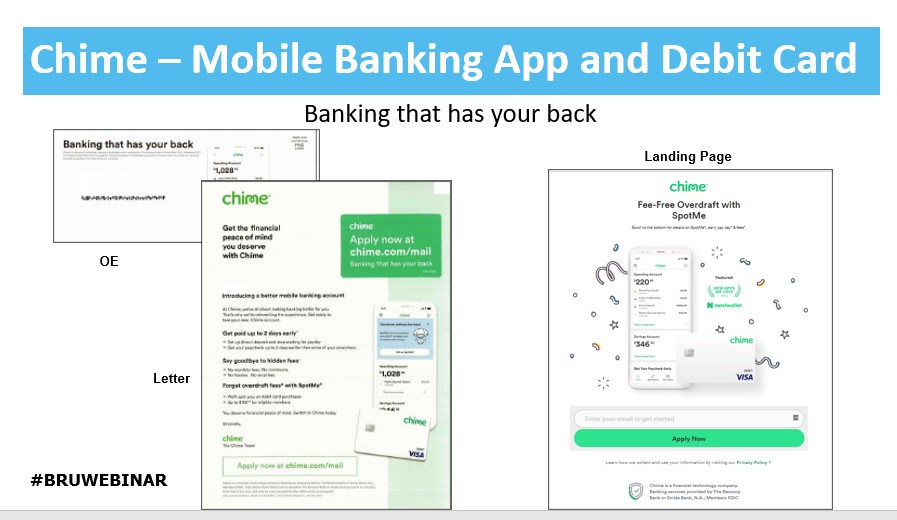

Many Fintech companies are using this approach. For example, Chime uses a traditional #10, with an envelope and letter. There is no response device or any other elements in the package. It links to a landing page where you can sign-up for a mobile banking app and debit card. This approach appeals to a younger cohort for whom the idea of a paper-based checking account seems a little Stone Aged. Chime knows this and they are trying to serve the dual needs of a consumer who is:

1.) more debt-averse and

2.) wants more control over their spending

3.) building up their credit history

Granted, direct mail has been changing, adapting, and evolving over the last several years, but these changes seem to have been accelerated over the last 24-36 months.

Design, layout, and the physical form of direct mail are changing.

For example, we see more non-envelope direct mail, like postcards and self-mailers. Likewise, direct mail packages have fewer individual elements within them than they did just a few years ago.

And although calls-to-action and providing ways to respond are still important for direct mail, the traditional physical response device and reply envelope are no longer mandatory elements in direct mail packages.

You’ll also note that copy has become shorter, with lower word counts — and designs are more streamlined, scannable, and overall, packages are easier to comprehend with just a quick glance.

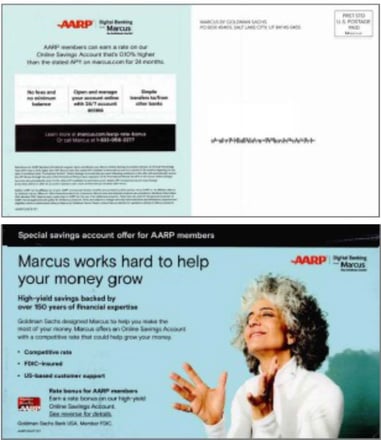

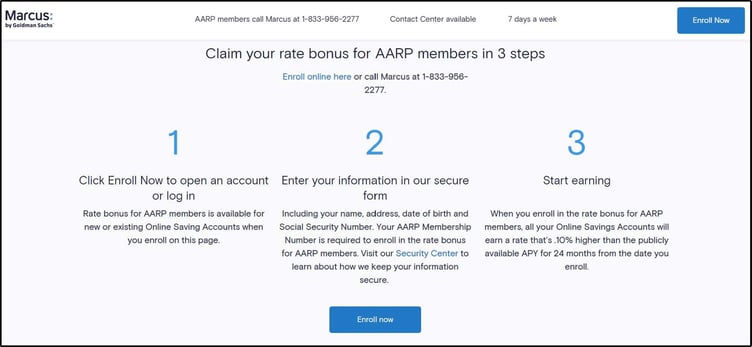

This is a co-branded savings offer from Marcus by Goldman Sachs and AARP. Marcus is a fintech, although one backed by a fairly mainstream financial brand, Goldman Sachs. Fintechs are not just for Millennials and Gen Z’s. Note that it is a postcard with an offer to apply by phone or landing page.

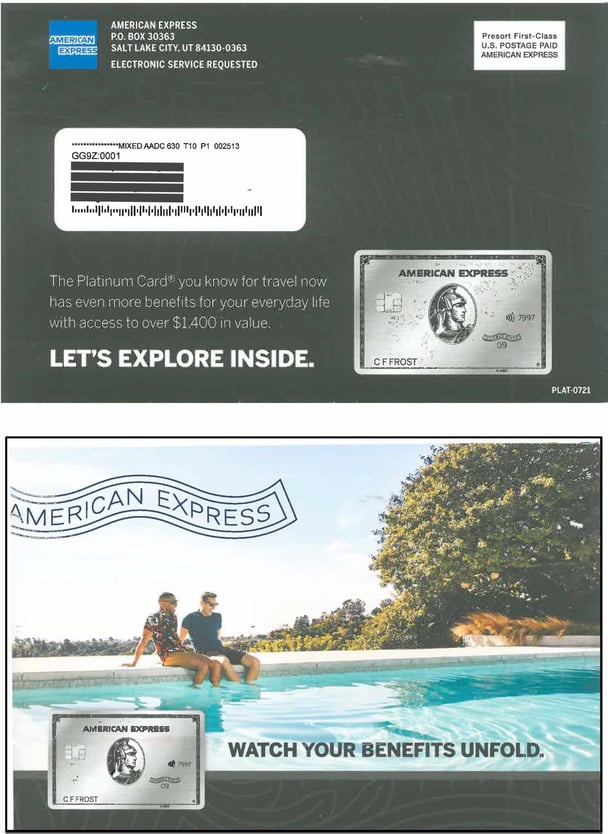

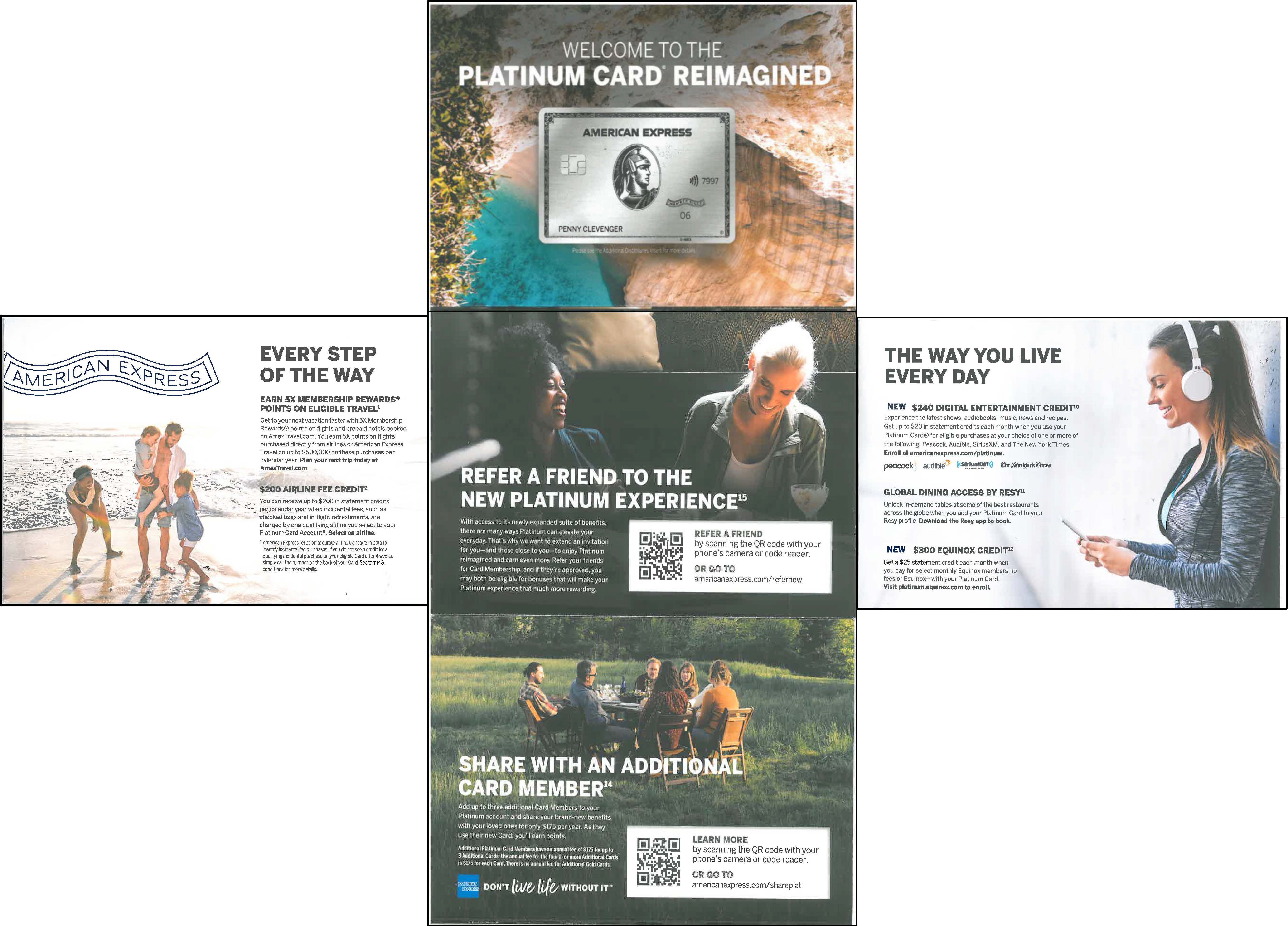

This self-mailer for the American Express Platinum Card is a customer benefits mailer. The goal is to engage customers, activate them and get them to refer friends or add another card member to their own Platinum Card account. The style is sometimes called an “Iron Cross.” It’s a fold-over with multiple panels. As it is unfolded, each panel reveals a little more information and messaging.

Key Takeaways:

Direct mail can help reach and influence multiple audiences

Direct mail can make use of new devices, new channels, and new ways to interface

with consumers.

Direct mail is still a healthy and important channel for financial brands

The classic direct mail kit is hard to find: New formats, hyper-personalized messaging, fewer elements, and new ways to respond are now the norm

Direct mail is effective with Millennials and Gen Z, not just aging Boomers

Changing, evolving, and adapting to customers' needs is something marketers will need to do in the months and years to come. As you begin to build your next campaign, contact J&C.

J&C can help you understand what’s new and prepare for what’s next. Our mission is to shatter response rates for financial, insurance, and any other companies in the regulated and restricted products market.

To learn more, get in touch with J&C today.

Topics: Direct Mail

303 E Wacker Drive, Suite 2030

Chicago, IL 60601

Phone: 312-894-3000

Fax: 312-894-3005