J&C Blog

Find all the latest marketing trends on the J&C Blog.

Find all the latest marketing trends on the J&C Blog.

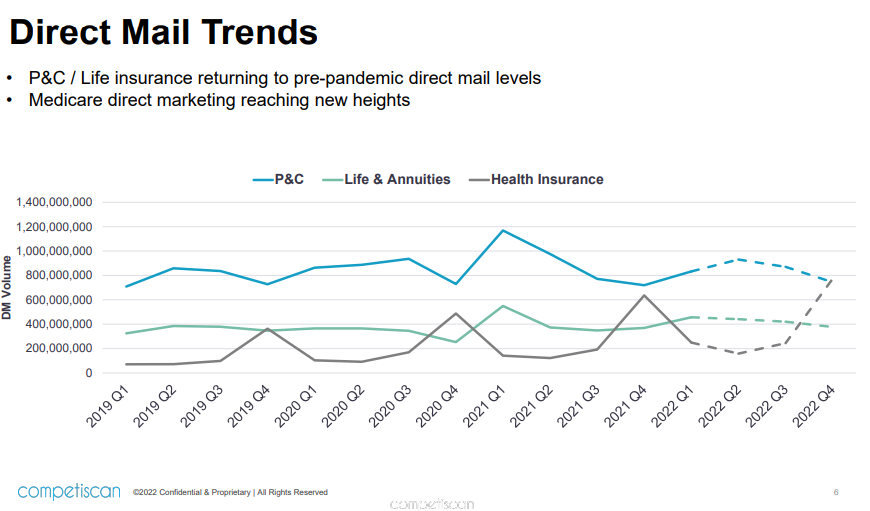

Paper costs are soaring… printing costs more… postage just went up… but insurance marketers continue to rely on direct mail for the results they need. In fact, consumers saw a slew of direct mail in Q4 2022. Here's one reason why...

Rich Goldman, CEO & Founder of Competence, a competitive intelligence market research firm thinks that direct marketing activity in life, health, P&C, and Medicare insurance is not going to remain status quo — but it’s actually going to increase.

So, if you’re planning a campaign, you may want to drop it sooner than later, because in Q4 consumers are going to see a deluge of direct.

Unwieldy inflation, sputtering supply chains, and increasing interest rates haven’t done much to tame the insurance industry’s enthusiasm for direct mail marketing, Goldman said on a recent Society of Insurance Research webinar.

Plus, as more and more insuretechs dive into direct mail marketing, volume will continue to rise. On the flip side, e-mail and internet marketing efforts may be slowing down. Insurers just have not seen the ROI they need from those channels.

Goldman noted that in 2021, health insurers “dipped their toes in the digital marketing waters” but they didn’t get the results they had hoped for. And for that reason, they've scaled back.

Interestingly, Goldman noted that the messaging and content insurers are putting in their direct mail material aren't shy about addressing the issues of the economy and rising princes head-on.

“We've seen a 406% increase in mentions of inflation, interest rates, and supply chain in life insurance material,” he said. “It's up 333% for health insurers.”

He went on to say that he believed property and casualty insurers would offer even more discounts if inflation continued to rise.

“Consumers and the property casualty companies are lockstep in agreement that they should be looking at discounting as key,” he said. “And in fact, we've seen a 74% increase off auto insurance discount offers since the start of the pandemic.”

Consumers are getting bombarded

Today’s consumer is overwhelmed and often confused by the onslaught of direct mail, telemarketing, and digital advertising from third-party Medicare providers, And last year alone, the federal Center for Medicare and Medicaid Services received more than 15,000 complaints about questionable statements in broadcast and in direct mail packages. As a result, the CMS put out new rules limiting the number of third parties that could market Medicare Advantage plans.

“It’s not that the ads are misleading necessarily,” Goldman said. “But it's the feelings of 15,500 consumers that felt they were misled you can’t s argue with those feelings.”

As worries about a recession continue, Goldman highlighted a successful marketing campaign The Hartford ran during “The Great Recession.” It focused on the company’s history, longevity, stability, and strength during difficult times.

“We may or may not be heading into another recession,” he said. “But our advice is you might want to get your materials ready in case. There might be some strong headwinds, so you want to have pictures of how you’ve been around for 150 years … and what have you. Those things resonated for The Hartford with consumers, agents, and producers.”

Bottom line is, mailboxes are going to be crowded in Q4. If you need help creating a highly responsive, insurance focused direct marketing campaign, turn to the experts who have been using direct response techniques to target insurance and financial customers for over 40 years, contact J&C.

Topics: Direct Marketing, Insurance Marketing, Direct Mail, Creative

303 E Wacker Drive, Suite 2030

Chicago, IL 60601

Phone: 312-894-3000

Fax: 312-894-3005